Introduction

ESEF Filing season is around the corner and as we are heading towards Year 3 of ESEF reporting under ESMA mandate, here are the 3 updates that filers and software vendors need to keep in mind. The (ESEF) stands as a transformative force, reshaping how companies disclose their financial information. As we embark on Year 3 of ESEF reporting under the mandate of the European Securities and Markets Authority (ESMA), it’s evident that the journey towards digital financial reporting maturity is far from over. With each passing year, new insights emerge, challenges surface and stakeholders adapt to ensure compliance while striving for operational excellence.

As the ESEF filing season looms on the horizon, filers and software vendors alike must fortify their understanding of the latest developments shaping the regulatory landscape. Year 3 brings with it a confluence of updates, enhancements, and refinements, each carrying implications for how financial data is tagged, validated, and presented. Against this backdrop, this blog elucidates three pivotal updates that demand attention as we navigate through another year of ESEF reporting.

ESMA Manual Update 2023

ESMA came out with the reporting manual update in September 2023, which the stakeholders need to take into consideration, to make sure that the ESEF report 2023 complies with them tagging-wise as well as validation-wise. Below are a few updates which are still in discussion and are not mandatory for this year because of the ambiguity in their interpretation.

Calculation 1.1 under Guidance 3.4.1

Under XBRL 2.1, specifically in the context of an ESEF report, the calculation link base must adhere to a specific condition. This condition stipulates that the calculation link base can only be developed for financial statements where all line items share the same context, encompassing both the period and identical dimensional qualifiers. For example, for Balance Sheet items that represent a specific date, an Instant period is employed. Conversely, for Income Statement items reflecting activities over a defined time frame, such as 12 months, a Duration period is utilized. The requirement for identical dimensional qualifiers ensures consistency in reporting structures.

Nevertheless, the Primary Financial Statements introduce a challenge as they encompass cross-period arithmetic relationships as well that cannot be adequately captured in the calculation linkbase. An example of this is evident in the Statement of Equity, which includes elements such as Opening Balance of Equity, Closing Balance, and changes throughout the year. In such cases, the traditional approach of preparing the calculation linkbase is not possible.

ESMA has acknowledged challenges associated with XBRL 2.1 and has suggested that potential solutions might be found in Calculation 2.0 (although not formally recommended by XBRL International) or Calculation 1.1, which is provided by XBRL International. However, it’s crucial to note that both Calculation 2.0 and Calculation 1.1 are currently discouraged for use in the 2024 filing season. As a result, the calculation specification presently in use should remain applicable for the upcoming filing season. Filers are advised to stick to the existing standards and recommendations until a more formal and widely accepted solution is established.

Reporting package under Guidance 2.6.1 & 2.6.2

In Guidance 2.6.1, ESMA suggests following the guidance outlined by XBRL International regarding the inclusion of Inline XBRL in a taxonomy package. Additionally, ESMA offers an updated link for software firms that encompasses mandatory specifications to ensure adherence to the provided recommendations.

For scenarios involving multiple Inline XBRL documents within a taxonomy package, Guidance 2.6.2 advises embracing the approach proposed in the specification of report packages. ESMA also furnishes an updated link to mandatory specifications directed at software firms, providing clarity on the recommended procedures for managing multiple Inline XBRL documents within the taxonomy package. ESMA had multiple discussions with XBRL International concerning the above Recommendation. Though an explicit reference from ESMA was not available, the legacy taxonomy package containing Inline XBRL reports in the ‘report’ folder conforms to the guidelines in the document dated September 22nd, especially as ‘Unconstrained report packages’.

As long as submitting ‘Inline XBRL report packages’ is not a formal requirement, it is permissible to submit them in the same format as in the past year. By default, OAMs (Officially Appointed Mechanisms) have no reason to reject their submission.

ESMA Taxonomy- 2022 version 1.1

ESMA has recently issued version 1.1 of the ESEF taxonomy for the year 2022, introducing three main modifications and the software providers need to update the tagging software as per the same, to be equipped with the latest version of the 2022 taxonomy though it’s not mandatory for 2024. This the filers should also discuss with the auditors and the software providers.

Correction of French Label:

The initial change focuses on rectifying the French label associated with the IFRS concept “DisclosureOfIntangibleAssetsAndGoodwillExplanatory.” This correction aims to improve the accuracy and consistency of labelling for enhanced clarity in financial reporting.

Amendment to Linkbase Formula:

The second modification involves revising the link base formula. Specifically, there was an oversight in updating the scheme for “percentItemType” (percentages), leading to issues in the checks for the accurate use of percentages. This adjustment addresses the functionality of percentage-related checks.

Explicit Prohibition of Standard IFRS Labels:

The latest change explicitly prohibits the use of standard IFRS labels on abstract elements that mark the beginning of each part of a financial statement (e.g., IncomeStatementAbstract). This prohibition is introduced to ensure conformity and consistency in financial reporting.

UKSEF Taxonomy

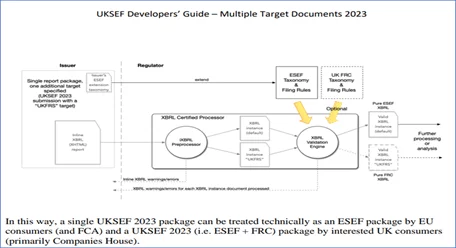

UKSEF, the UK’s iteration of ESEF, is regulated by the Financial Reporting Council (FRC). It considers the distinct requirements of companies for statutory reporting and aligns with the regulatory reporting needs of the FRC. UKSEF facilitates the inclusion of UK-specific tags in conjunction with those defined by ESMA.

From 2021 UK based filers had the option of using the UKSEF taxonomy to file their annual reports. The UKSEF taxonomy has undergone some significant changes in the past three iterations and is now ready to be used by the filers with the latest 2023 UKSEF taxonomy.

UK filers utilizing UKSEF will utilize the ESEF taxonomy along with an extra taxonomy featuring UK-specific tags. Filers must make a selection between FRS102 or IFRS entry points for the secondary taxonomy incorporated in the report. With the two-taxonomy approach in the UK, there will be technical challenges in the process of reporting compliance The visual representation of this choice is depicted below.

Conclusion

In conclusion, it is crucial for filers to initiate discussions with both auditors and software providers concerning the updates mentioned above. This proactive engagement is essential to ensure a seamless and efficient adherence to ESEF/UKSEF reporting standards. Service providers can also contribute significantly by assisting filers in conducting a pilot run of the report, facilitating readiness for compliance with UKSEF requirements.

As we stand on the cusp of another ESEF filing season, the imperative of proactive engagement cannot be overstated. By fostering dialogue with auditors and software providers, filers can navigate the complexities of digital financial reporting with confidence and agility. Through collaborative efforts, stakeholders can transcend compliance to embrace operational excellence, unlocking the full potential of ESEF as a catalyst for transparency, efficiency, and innovation in financial reporting.