The ESEF mandate now moves into Phase II, requiring public companies in the European Union and the UK to block tag the ‘Notes to Accounts’. The companies are now required to block tag their notes to financials along with their financial statements.

About the ESEF Mandate

The ESEF Mandate came into effect in January 2021 in the Europe Union and the UK. As per the ESEF Mandate, companies are now required to submit annual reports in the Inline iXBRL format instead of PDFs. The mandate has two phases.

In Phase I, effective from January 1, 2021, listed companies were required to perform the XBRL tagging for consolidated financial statements alone.

In Phase II, effective from January 1, 2022, companies are required to block-tag their notes to accounts along with the financial statements.

Block Tagging

Every disclosure present in the annual report under the notes to accounts (explanatory notes and accounting policies) needs to be tagged with an ESEF Taxonomy element.

Important points for Block Tagging:

- ESMA recommends that issuers only use elements from Annex II for block tagging the notes to accounts.

- There are around 256 elements under Annex II which can be used to block tag the notes to accounts in the annual report.

- However, “ESMA also encourages issuers to apply core taxonomy elements listed in Annex VI which are not part of Annex II, or to create extension elements to block tag such disclosures since this information is useful to end users”.

- In case issuers cannot find appropriate elements in the taxonomy for certain disclosures, they can represent such disclosures with company-specific elements or extensions, along with their anchoring.

- ESMA also recommends following the same way of anchoring extension elements (TextBlockItemType) as we did for (MonetaryItemType) elements last year to maintain consistency.

We will now look at ESMA guidelines for block tagging the notes to financial accounts.

Guidance on Marking up Notes and Accounting Policies

As per the latest ESEF reporting manual, ESMA has introduced two different levels of block tagging that companies must perform on the 2022 annual report. They are:

- Single level Tagging

- Multi-Level Tagging

- Policies

- Notes with Nesting of tags

In the case of disclosures corresponding to more than one element of different granularity (with narrower and wider elements), preparers should use each of them and multi-tag the information to the extent that corresponds with the underlying accounting meaning of the information.

Single Level Tagging

We need to block tag each disclosure reported under the notes to the financial statements separately, with appropriate elements from the ESEF taxonomy. For example, if 30 disclosures are reported as a part of the notes to financials, then we need to consider 30 disclosures as 30 facts and tag them using elements from the ESEF taxonomy.

Multi-level Tagging

There are two different types of multi-level tagging – one for policies and the second for notes which are structured for Nesting of tags.

Policies

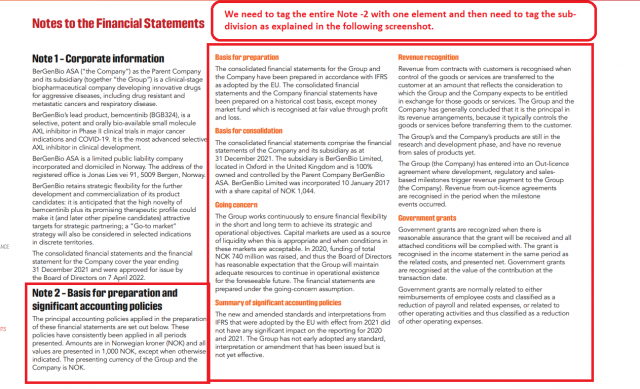

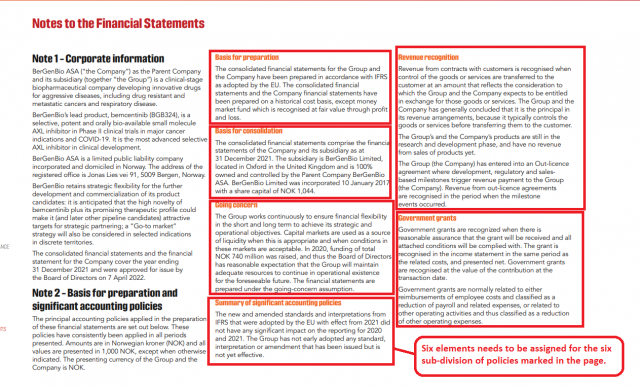

As per ESMA’s latest ESEF reporting manual, companies are recommended to apply multi-level tagging on policy disclosures.

First, we need to block-tag the entire policies disclosure using the appropriate element from the taxonomy and then we are also required to tag all the subdivisions of policies separately using the appropriate element from the taxonomy if available or else use the custom element.

Example: If there are 14 subdivisions of the policies reported then we need to use 14 different elements to tag the subdivision of policies.

As per the latest ESMA reporting Manual, issuers need to perform multi-level tagging for a few notes where there are more than one element of different granularity (with narrower and wider elements).

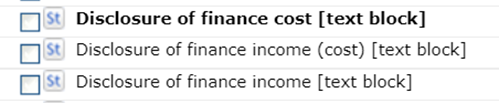

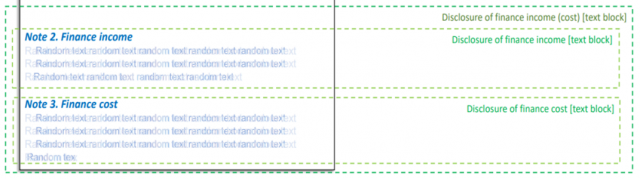

There are few elements present in the taxonomy with both accounting meaning single-way and dual way. (For ex – The below three elements: Separate tags for Finance Cost and Finance Income & One netted tag as Finance Income (Cost)).

In such a scenario, where both single-way tags (Tags with a single meaning. Example: A tag related either to Finance Income or Finance Cost) and dual-way tags (Tags with dual meanings. Example: A single tag related to both Income and cost) are available in the taxonomy then we need to perform multi-level tagging. Single-way tags to block tag two different notes and Netted tags to tag both notes as one text block.

While there are rounds of discussions going on regarding the approach to be adopted for the 2022 AR filing, the structure of the hierarchy and the tagging should be comprehended from a more logical perspective. It will also be a big challenge for the vendors to structure the hierarchy and maintain the formatting of the highly stylized annual report after performing block tagging of notes.