Financial reporting analytics involves using data and advanced analytical techniques to extract insights from financial statements and other financial data. It helps organizations to make better decisions, identify areas of improvement and understand their financial performance. It is used to identify trends, forecast future results, and evaluate the effectiveness of financial strategies.

Financial reporting analytics can be challenging due to several factors. One of the biggest difficulties is the complexity of financial data. It may be difficult to identify meaningful patterns and insights in such complex data. Another difficulty is the need for accurate and reliable data. Inaccurate or unreliable data can lead to poor decision-making. Additionally, financial data can be incomplete or inconsistent, which can make it difficult to draw meaningful conclusions.

Another major challenge is the need for advanced analytical skills. Financial reporting analytics requires knowledge of financial reporting standards and accounting principles, as well as proficiency in analytical tools and techniques. Additionally, analysts need to be able to work with large data sets, which require powerful computer hardware and software.

However, analytics can be easier if digital standards are used to report financial information and special tools are employed to access such digital information and make sense of the numbers. In this blog, we will address how data submitted to the Federal Energy Regulatory Commission (FERC) by US energy companies can be effectively analyzed.

Financial Analytics for FERC XBRL Filers

A year ago, the Federal Energy Regulatory Commission (FERC) successfully transitioned to XBRL-based data collection, moving away from an obsolete Visual FoxPro-based filing system. US energy companies now file quarterly and annual reports in digital format, creating interesting possibilities for the future use of their data.

XBRL, or eXtensible Business Reporting Language, is the de facto standard for financial reporting preferred by regulators across the globe. A machine-readable language, XBRL increases the usefulness of digital documents by rendering their data easier to transmit, analyze, and compare. XBRL documents stand in stark contrast to PDFs and paper files which can only be understood by a human reader. The machine-readable tags in an XBRL document help computers understand the reported data, enabling software to slice and dice information and throw up insights to improve decision-making for an informed user.

However, the tools needed to analyze XBRL data are different from those used to prepare XBRL documents. XBRL reporting solutions enable users to prepare FERC documents by allowing them to upload data to pre-defined Form templates. Analytics solutions, meanwhile, need to be connected to XBRL data repositories, from where they can extract large pools of financial information at a single click. IRIS iConnect® is an XBRL data analytics solution brought to you by the team behind IRIS CARBON® – a SaaS platform for streamlined FERC XBRL reporting.

Introducing IRIS iConnect®

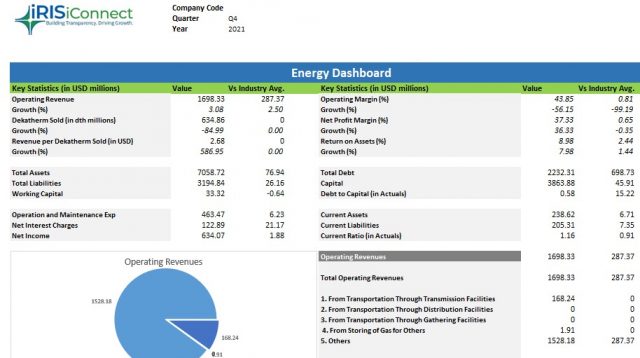

The single biggest challenge for analytics is the availability of data. The IRIS iConnect® is integrated with the FERC portal, from which it retrieves company filings going back to 2011. Companies can use the available data to derive insights that improve their efficiency, including peer-to-peer comparison. Some of the key functionalities of IRIS iConnect® include company dashboards and in-built ratios.

Dashboards

Here are screenshots of two energy company dashboards

Apart from the dashboard, IRIS iConnect® provides users with a set of in-built ratios that can help them test the soundness of their financial position.

In-built Ratios

Working Capital Ratio

The working capital ratio is a measure of an organization’s liquidity. It helps analysts know whether a business can pay its obligations. The working capital ratio compares current assets and current liabilities and indicates whether a business can pay for its current liabilities with its current assets. A working capital ratio of less than 1.0 indicates there could be liquidity problems. A ratio closer to 2.0 is considered good for short-term liquidity.

Return on Assets

Return on assets indicates a company’s profitability in terms of its total assets. It indicates the efficiency with which a company is using its assets to generate profits. The metric is a percentage of net income and average assets. A higher return on assets describes a company’s ability to manage its balance sheet and generate profits.

Total Debt

Total debt is compared with a company’s total assets. It indicates the extent of leverage in relation to a company’s assets. The ratio varies across industries, with capital-intensive businesses reporting a higher total debt compared to others. A debt ratio greater than 1.0 or 100% means a company has more debt than assets. A ratio of less than 100% indicates more assets than debt.

Net Profit Margin

Net profit margin represents the revenue that remains after all expenses are deducted from sales. It indicates the level of profit a business can derive from its total sales. A business with a high net profit margin is seen to be pricing its products right. This margin is useful to compare businesses in the same sector due to a similar environment, customer base, and cost structure. A net profit margin of over 10% is favorable but can vary by industry and business structure.

Operating Margin

The operating margin indicates the efficiency of a company’s core operations to generate profit. It represents per-sale efficiency after accounting for variable costs and before paying interest or taxes. This margin is best compared between immediate competitors and is not effective for comparison across sectors. Operating income must be divided by sales to derive the operating margin.

Debt to Equity Ratio

The debt-to-equity ratio compares total liabilities and shareholders’ equity. It can indicate a company’s reliance on debt. The debt-to-equity ratio varies by industry. Therefore, it is best used to measure the debt levels of direct competitors or changes in a company’s reliance on debt over time. Energy companies with a higher debt-to-equity compared to their peers have a higher default risk.

Fixed Assets Turnover Ratio

The fixed asset turnover ratio is a comparison of net sales and net fixed assets. It indicates a company’s ability to generate revenue through its fixed-asset investments. A low fixed asset turnover ratio would indicate that the company is over-invested in fixed assets and might have to revive its sales. It also indicates that the company has invested in assets that are not making production more efficient.

Capital Turnover Ratio

Capital turnover, also known as equity turnover, compares annual sales to total equity. The capital turnover ratio intends to measure the revenue a company can generate with the equity employed. Analysts can also measure the capital investment a specific industry requires to generate revenue. Energy companies can use this ratio to estimate the efficiency of the capital they employ to bring revenues.

Here’s another screenshot showing how IRIS iConnect® displays three different companies’ figures and ratios for a peer-to-peer comparison.

![]()

What Energy Companies Can Achieve with FERC XBRL Analytics

Financial reporting analytics can help energy companies extract valuable insights from both their own and their peers’ FERC schedules and use them to improve decision-making and support strategic planning. By leveraging advanced analytical techniques, these companies can identify trends, forecast future results, and evaluate the effectiveness of financial strategies.

Improve Financial Efficiency

One of the key benefits of financial reporting analytics is the ability to identify areas of improvement. For example, by analyzing financial data, energy companies can identify areas where they are overspending or underperforming. This information can then be used to adjust and improve financial performance through initiatives to cut costs and increase revenue.

Forecast Future Performance

Financial reporting analytics allows organizations to create financial models that can be used to predict future financial performance. This can be particularly useful for energy companies looking to make strategic decisions, such as expanding into new areas or launching new production facilities.

Evaluate Financial Strategies

Energy companies can use data to measure the return on investment of a particular strategy, such as a marketing campaign or an investment in new technology. This information can then be used to make adjustments to improve the effectiveness of the strategy.

Improve Regulatory Compliance

Energy companies can use financial reporting analytics to also comply with regulatory requirements and ensure that financial statements are accurate and compliant with the FERC’s XBRL taxonomy. This can help the companies improve their communication with various stakeholders.

Improve Decision-making

Financial reporting analytics can help companies make better decisions. By providing insights into financial performance, companies can make more informed decisions that are better aligned with their strategic goals. This can help them be more competitive in the marketplace and achieve long-term success.

In Conclusion

Financial reporting analytics is a powerful activity, especially when done using tools like IRIS iConnect®. It can help organizations extract valuable insights from the FERC schedules and other financial documents. It can be used to identify areas of improvement, forecast future results, evaluate the effectiveness of financial strategies, comply with regulatory requirements and make better decisions. It helps organizations to improve their financial performance and achieve their strategic goals.

Driven by the XBRL data standard and coupled with attractive dashboards and in-built financial ratios, financial analytics using IRIS iConnect® can make all the difference for higher financial and operational efficiency for energy companies.